Top Node.js Development Companies in India

November 15, 2024

Home >> Software >> Cash Management Software: Costs & How to Manage Cash Flows

Quick Summary

Any business for sure does not want to go through the disastrous cash shortages experienced by neglecting cash management. Developing cash management software ensures that one has enough liquidity to meet the financial obligations at hand. In this blog, we will be discussing why cash management software is crucial, how to build it, cost considerations, and tips that could give one a competitive edge.

Cash flow management is very essential for all SMEs and even large businesses. It is monitoring how cash flows in and out plus managing cash needs, which would be pretty stressful. Cash management software makes it so easy to handle this. It increases your accounting efficiency and financial control where you will track your transactions, account keeping, and generate useful reports for your convenience. However, developing software tailored to your specific needs can take considerable time. This guide will help you navigate the latest software development trends to create a proper software platform that addresses critical cash management needs and drives future business growth.

Cash management software development focuses on creating custom software simplifies business financial processes. It automates cash flow tracking, budgeting, account reconciliation, and financial reporting tasks. Common features include managing expenses, handling invoices, and producing digital financial reports.

With over half of businesses (53.90%) adopting automation tools, cash management software plays a crucial role in reducing the workload on finance teams, improving cash flow visibility, and aiding better financial decisions.

This software also helps lower fraud risks and control expenses, leading to more effective capital management. As a result, the market for cash management software is projected to grow at an annual rate of 12.6% by 2030.

The simplicity that companies need in their financial processes is the reason why the cash management software market has a rapidly growing appeal. Platforms help make processes more routine from monitoring cash flow to overseeing liquidity, and payment processing thereby giving them better control over their finance. The use of such software gives businesses better visibility of their cash position, and thus they make better financial decisions.

Major factors that drive market growth include higher automation demand, current financial information needs, and the need for security features in transactions. Another factor that contributed to the growth of cash management software was the shift toward cloud-based solutions. Businesses have found an efficient way to handle finances with the use of cash management software.

Cash management software belongs primarily to markets of banking, retail, healthcare, and manufacturing. As risk management and financial efficiency will consistently be the top priorities, demand for this tool will naturally increase in the future.

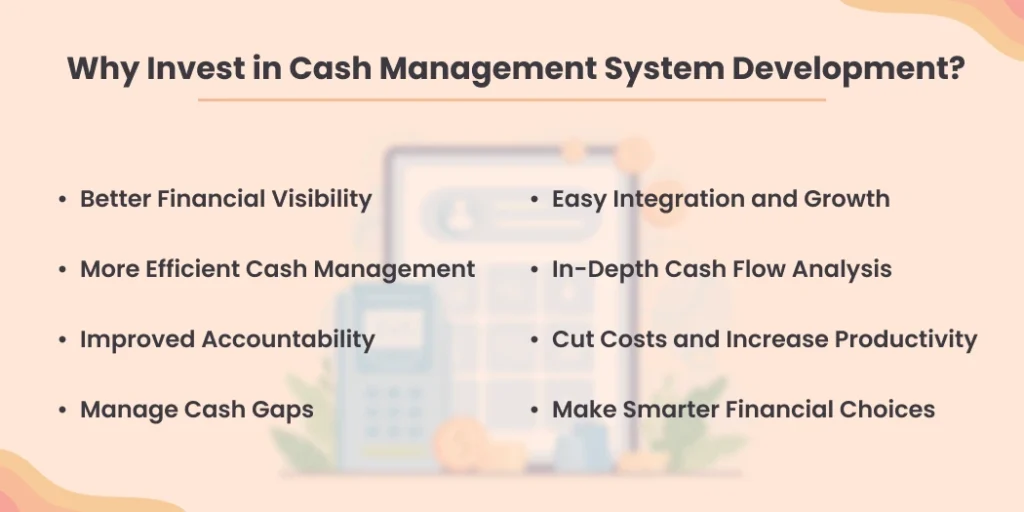

Investing in a cash management system will be the next smart business move. This will then provide you with the right tool and insight into managing cash flows, improving your decision-making, and ultimately even more future growth.

With this system, you get a glimpse of the cash flows in real-time, tracking income and expenses, as well as all financial activities that involve cash in one shot.

It helps you spot excess cash that can be used to pay off debt, invest for higher returns, or save on interest payments.

A cash management system ensures you follow financial regulations and internal policies, making your operations more transparent and ethical.

By analyzing future cash flows, the system predicts potential shortages or surpluses, helping you address issues before they become problems.

Connects easily with your existing financial systems and scales as your business grows to stay running smoothly.

The system provides you with a well-defined view of the patterns in your cash flow, thus helping you find opportunities while noticing risks early and mitigating them.

More automation entails lesser manual work; hence, the cost of operations is lower, and errors are reduced, thus giving room for boosting efficiency.

You will hence be able to make informed choices on where to invest, how to manage expenses, and how to allocate resources.

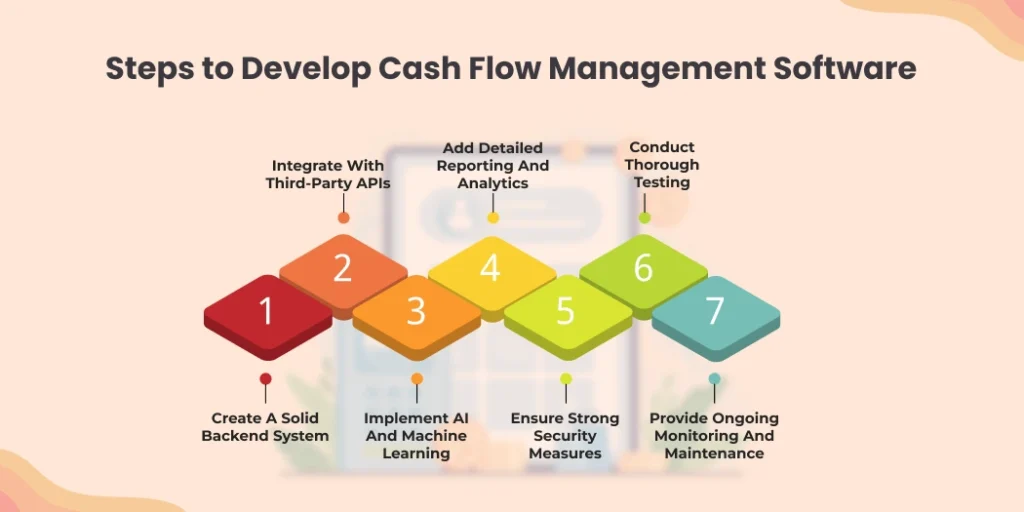

Building cash flow management software tailored to business needs requires a clear process. Here’s how you can create a solution that helps track and manage cash flow effectively.

The backend forms the backbone of the software, managing databases, servers, and APIs. A strong backend ensures the software processes data efficiently and performs well overall.

Use APIs, such as those from banks, to allow seamless data sharing between the software and external systems, enhancing functionality and connectivity.

Leverage AI and machine learning to provide features like cash flow forecasting and risk detection, offering users advanced insights for better decision-making.

Incorporate comprehensive reporting and analytics tools to help users monitor cash flow and financial performance, offering valuable data for business growth.

Protect sensitive financial data with encryption, authentication, and access controls, safeguarding customer information and maintaining security.

Before launching, test the software extensively to catch and fix any bugs, ensuring smooth and reliable operation from the start.

After the software goes live, continuously monitor its performance and gather user feedback. Regular updates will keep it aligned with changing business needs.

To guarantee the seamless operation of your financial activities, consider these key factors when choosing the ideal cash management software for your business:

Best Practices for Developing Effective Cash Management Software

Your cash management system should be tailored to meet your specific requirements. It must offer flexibility to adjust according to your distinct business processes and organizational structure.

An effective interface is essential. It should be designed for easy navigation and visual appeal, ensuring that users of all technical backgrounds can operate it effortlessly.

The software must facilitate collaboration among multiple users with varying levels of access. This feature enables team members to work together effectively while ensuring that the right individuals have access to the necessary information.

Select software that can expand alongside your business. It should accommodate an increasing number of users, transactions, and accounts as your organization grows.

Protecting data is paramount. Seek out systems that provide encryption, secure storage solutions, and stringent access controls to protect sensitive financial information.

Choose software that can easily integrate with existing tools your company utilizes, such as accounting software, banking systems, and ERP solutions, to enhance operational efficiency.

Explore additional functionalities like budgeting, forecasting, or analytics that can deliver valuable insights and support better financial management.

Cash management software provides a clearer view of your surplus cash balances, and thus you are better placed to make informed financial decisions.

This software provides you with real-time access to the latest data and helps you move fast in response to changes in your financial environment.

By using appropriate data you can develop better strategic and hence highly profitable business decisions, helping you advance towards your set financial goals.

Cash management does not only save you time but also helps to utilize all your money resources to enable growth in your business.

The cost of a cash management system would depend on a long list of factors that include the requirements of the features, the complexity level of the project, and the amount of customization involved. Generally, it ranges between $40,000 and $250,000, depending on the specific needs and scopes of the project.

Creating cash management software is a very complicated task, as it is not only about choosing the right tech stack and ensuring security but also about general customization and integrating it with other systems. That will be what defines whether your project will be successful and, especially, whether it can make good use of its budget or not, relying on your finance software development team.

Building a cash management solution is nothing less than that one-size-fits-all task, but multi-layered with a clear plan, plus skilled people and the involvement of customers. When you are aligned with our team, then you take a strategic approach. You’re working with software that’s giving you better control over your cash flow, greater visibility into financial performance, and significant enhancements in operational efficiency. These impacts towards stronger financial health and sustainable growth.

Managing cash flow is a great way to strengthen your business financially. Well-established management of cash flow will create an effective process of streamlined operations, better control over finance, and the best possible decisions for the future. With a customized built solution, it benefits by tailor-making the software according to specific business needs, hence running more smoothly.

If you are prepared to build or improve your cash management process, you’ll need some expertise. Hire Software Developers from Tagline Infotech to develop a solution that will increase efficiency, scale your business, and provide you with greater financial control. Your business then sets up for sustainable growth and success.

Cash flow is the process of money movement in cost management within an organization. In effect, efficient management enables a business company to meet its expenses, invest well, and have enough liquidity.

These digital tools help businesses streamline cash handling, like budgeting software, payment systems, and cash flow forecasting tools.

A business using software to schedule and automate bill payments is a good example of cash management, ensuring timely payments and preventing overdrafts.

Digital Valley, 423, Apple Square, beside Lajamni Chowk, Mota Varachha, Surat, Gujarat 394101

D-401, titanium city center, 100 feet anand nagar road, Ahmedabad-380015

+91 9913 808 2851133 Sampley Ln Leander, Texas, 78641

52 Godalming Avenue, wallington, London - SM6 8NW