A Guide on Data Visualization in ReactJS and...

May 15, 2024

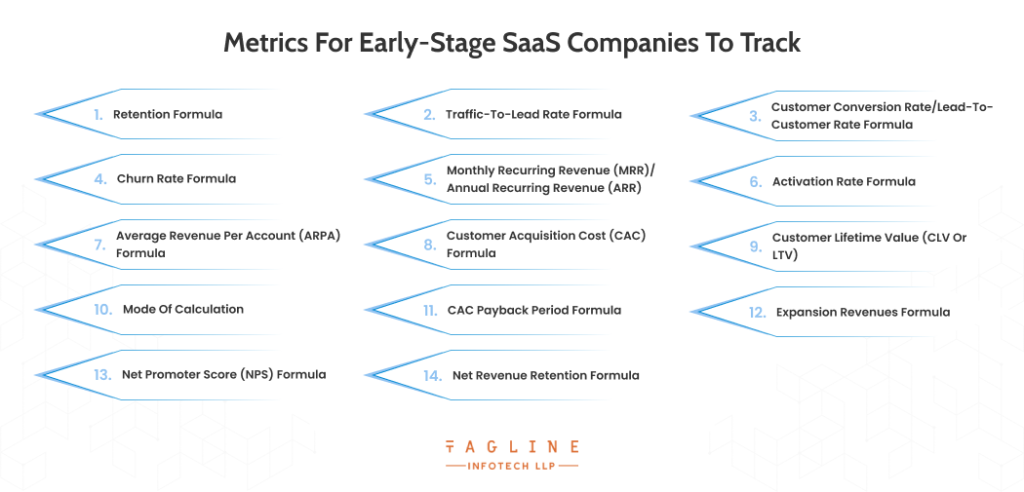

Home >> SaaS Development >> 14 Metrics Every SaaS Company Should Care About

The SaaS metrics are a popular way to check your Software-as-a-service organization’s performance. The businesses can succeed as they enrol many new users and retain existing subscribers.

Carefully selected SaaS metrics offer real-time insights into the health and growth of your business.

Effective metrics predict customer retention, showcasing how SaaS businesses can distinguish themselves from competitors, even traditional on-premises software vendors.

Robust customer retention fosters long-lasting relationships, driving sustained growth, improved cash flow, and enhanced profitability.

The SaaS metrics serve as the benchmarks, allowing ventures to use them to track growth and performance.

These growth metrics help organisations check their future plans and adjust strategies and success measurements.

You can evaluate many metrics to know about your business performance.

Do know that the retention rate is never the same as the churn rate; moreover, it depends on product adoption.

The retention metrics are best known for driving growth and acquisition. It is a critical time, at least, to initiate.

The metrics that can be of help you in tracking retention include:

Going ahead with retention, the client can use more than 100 metrics for analyzing the business’s success. The individual can receive great responses quickly.

The retention rate, NRR or net revenue retention, shows how many clients you are retaining and how much you are spending.

Getting through new business is very important while keeping your existing clientele will be less expensive and easy.

Mode of calculation

NRR rate = (Retained revenue / Base recurring revenue) x 100

Importance

You can track the retention rate, but here, you need to consider the number of existing clients with you and how much they spend, as every client uses the product or service differently.

Many retained clients have adopted and upgraded many services or paid features. In contrast, many others have opted for lower value plans or even returned to the non-premium app versions.’

The net revenue retention will help you calculate the revenue value you have generated when considering churn rate and expansion revenue.

Knowing about the revenue coming from the existing clientele will help you evaluate the cross and up-selling efforts. It can also highlight the weaknesses that can trigger the downgrades.

The formula will help you track the visitor’s percentage reaching out to the website, and you can convert it quickly into a demo, trial or even any other lead.

Mode of calculation

Traffic-to-lead ratio = (# of visits ÷ the # of leads generated over the same timeframe) x 100

Importance

Many people put a lot of effort into marketing to bring traffic to the landing pages, but if the traffic is turned into leads, your efforts will be well-spent.

Now, watch the ratio to help you improve lead generation techniques.

However, it’s important to note that other factors, such as pricing, influence what constitutes a ‘good’ ratio (premium products might convert fewer leads)

Also Read : Everything you need to know about developing SaaS products

It captures the trailers and various other types of leads for the businesses.

Mode of calculation

Conversion rate = total # of trial users who signed up for paid subscription ÷ total # of trial users

Importance

The conversion rate here showcases the freemium or free trial subscribers and how they can become high-paying clients.

The high conversion rate indicates that the user is uncovering the product’s value and can use the features.

It also means that the onboarding procedure works precisely as required, guiding users via signing up along with the correct mixture of brevity and helpfulness.

The organization for whom the conversion rate has lost all the shine will scrutinise the onboarding procedure and the behavioural data where the users are falling off.

Even if the changes are small, they can improve the revenue with time.

The Churn is known for measuring the loss rate for two items.

Mode of Calculation

Churn rate = (# of churned customers in a period ÷ total # of customers to start period) × 100

Importance

Many SaaS organisations consider revenue churn above client churn because the previous methods better evaluate any organisation’s health.

Also, you can lose a lot of freemium clients in just 30 days without leaving any impact on the bottom line.

Churn rates also accumulate over time. When calculated annually, a 3% monthly churn rate transforms into a 36% churn rate.

This implies you must acquire over a third of your customer base anew to sustain the same revenue.

It measures the client revenue for every month. You can multiply the value by 12, giving you an annual run rate. The MRR can be calculated manually, but many tools are available online to estimate the real-time SaaS metrics.

Mode of calculation

ARR = Total contract value / # of years

Importance

If compared to the other alternatives, the recurring revenues ensure that the SaaS business model should be appealing. The client can pay monthly as long as you provide them value via your services.

It is one of the renowned SaaS metrics as the client experiences the activation as their aha moment.

It is the first time they have learned about your product’s value for themselves.

Mode of calculation

Activation = # of users to successfully reach your critical event / total # of users

Importance

The Activation rate applies to product-based growth models where the in-app experience leads to improvement.

The user experience activation is the aha moment when they realize the product’s value. The event will differ from one product to another.

Identifying the in-product actions that lead to long-term success and retention often requires a blend of detailed user journey mapping, user interviews, and behavioural analytics.

Commonly known as Average Revenue Per User (ARPU) or Average Revenue Per Customer (ARPC), this metric enables you to focus on specific customer groups, providing a clearer understanding of the value associated with each segment.

Mode of calculation

ARPA = MRR ÷ total # of active subscriptions

Importance

Suppose your company is making due efforts to enhance the monetary value of the subscription.

You will see the increased value in revenue, but you will need to be sure as it is because you have many users or worked towards improving the revenue per client account.

Concerned about declining revenue for your SaaS product?

Let our expert SaaS development team revitalize your offerings and align them with evolving consumer needs.

CAC can measure the money spent on marketing, sales and other costs for acquiring new clients.

To calculate it, you can divide the amount you spend on marketing and sales for the month by the new clients obtained in the period. The result will be the CAC.

Mode of calculation

CAC = Total $ spent on sales & marketing over a period ÷ # of a customer acquired within a period

Importance

Sometimes, it takes many years or months to earn back the money you invested in bringing the clients back.

Startups often look for the amount they have been spending on client acquisition, which will obstruct the growth path and make the flow of liquidity easier in the initial years.

Comparing lifetime value and acquisition cost will provide deep insight into marketing efforts to drive growth.

Mode of calculation

LTV-to-CAC ratio =

Customer lifetime value over a specific period / customer acquisition cost over a particular period

Importance

Consider this scenario: if you invest $1,000 to acquire a customer whose lifetime value to your company is also $1,000, your business won’t generate any profit.

Your company will lose all its money in operational expenditure.

10. Number of Active Users (NAU) Formula

Once you determine the number of users who are regularly using your SaaS product, it will help you to understand the behavior of your users.

Mode of Calculation

Number of Active Users (NAU) = (Number of Daily Users + Number of Returning Users)

Importance

NAU helps you to determine that customers with a constant habit of using SaaS software are better candidates to upsell your product rather than selling it to new subscribers.

You can also apply this calculation on Monthly (MAU), Weekly (WAU), and Daily (DAU) to get more accurate insights into your SaaS product.

The formula helps in recovering the costs of acquiring any new clients.

This metric will be more valuable than the LTV-to-CAC ratio as it gives a better idea of cash flow, which is needed to enhance the acquisition of clients.

Mode of calculation

CAC buyback period = CAC/MRR from a new customer

Importance

If the CAC is $500 and the new clientele is paying $25, it will take ten months to recover the price. The more time invested in recovering the client acquisition expenditure, the easier it will be to generate revenue for new clients by recovering the cost of acquiring them.

The goal behind this metric is how to minimize it; either you need to increase the pricing or reduce your expenditure.

It covers the increase in a one-time payment or MRR when your existing clientele tends to update with an expensive plan.

Mode of calculation

Expansion revenue = Total MRR generated by upselling and cross-selling

Importance

Stressing on expansion revenue will minimize the effects of the Churn. Highly successful expansion revenue can lead to a negative effective churn rate.

This concept, introduced by David Skok, refers to a situation where the revenue gained from expansions or upsells surpasses the value lost each month due to revenue churn.

It directly measures the value of the client gain via your SaaS product.

Mode of calculation

It can be calculated via the NPS Survey.

Importance

The NPS calculation will help in knowing why clients will dissatisfied with the product improvement.

The qualitative data received from the client feedback will help determine whether your product fits the market, especially in the early stages of SaaS business.

Looking closer at your overall retention metrics, net revenue retention (NRR) indicates the number of customers you’ve retained and their spending levels.

While acquiring new customers is crucial, keeping existing ones is easier and more cost-effective.

Mode of calculation

NRR rate = (Retained revenue / Base recurring revenue) x 100

Importance

It would help if you tracked the retention rate, but it will be essential to consider the client number you have retained and the amount spent. Only some clients are using the product in the right way.

Many retained clients have adopted and upgraded new paid services or features, while others have downgraded the plans.

Undoubtedly, SaaS is a competitive market in which you want to grow. The above metrics will ensure that your organization is going on the right path by allowing you to keep track of the business. You can contact the reputed organization if you need support tracking and identifying the growth metrics.

The Rule of 40 is a fundamental principle indicating that SaaS companies should make strategic and informed decisions to maintain a revenue growth rate and profit margin above 40%. By adhering to the Rule of 40, businesses can sustain growth and profitability while effectively managing cash flow and liquidity concerns.

Digital Valley, 423, Apple Square, beside Lajamni Chowk, Mota Varachha, Surat, Gujarat 394101

+91 9913 808 2851133 Sampley Ln Leander, Texas, 78641

52 Godalming Avenue, wallington, London - SM6 8NW